Debt Consolidation Decoded: Simplify Your Finances and Save

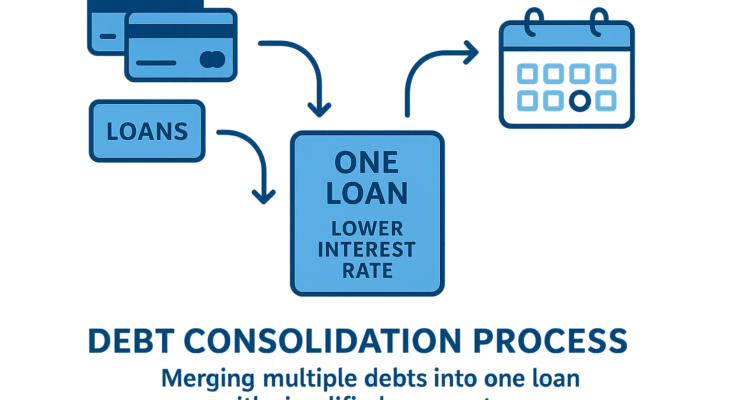

Debt consolidation is like merging a chaotic pile of puzzle pieces into one clear picture. It combines multiple debts—credit cards, personal loans, car payments—into a single new loan, often with a lower interest rate, simpler monthly payments, and a more manageable timeline. The goal? To turn financial chaos into clarity, reduce stress, and save money.

When Should You Consider Debt Consolidation?

- High-Interest Debts: Juggling multiple loans or credit cards with steep interest rates? Consolidation can slash what you pay in interest.

- Payment Overload: Struggling to track due dates for various debts? One payment means fewer missed deadlines.

- Interest Eating Your Income: If loan interest consumes a chunk of your paycheck, consolidation frees up cash flow.

- Strong Credit Score: A good credit history unlocks better rates, making consolidation a smarter move.

How Does Debt Consolidation Work? A Step-by-Step Guide

- List Your Debts: Gather all current debts—credit cards, car loans, personal loans—and note their balances, interest rates, and monthly payments.

- Crunch the Numbers: Calculate the total owed and compare it to what a consolidated loan might cost.

- Apply for a New Loan: Secure a consolidation loan with a lower interest rate, ideally from a bank or credit union.

- Pay Off Old Debts: Use the new loan to wipe out existing balances.

- Stick to One Payment: Focus on repaying the consolidated loan with a single, simplified monthly installment.

Real-Life Example: From Chaos to Control

Imagine you’re managing:

- Credit Card: 8,000 SAR at 18% (800 SAR/month)

- Car Loan: 12,000 SAR at 10% (900 SAR/month)

- Personal Loan: 10,000 SAR at 12% (1,000 SAR/month)

Total Monthly Payments: 2,700 SAR

After consolidating into a 30,000 SAR loan at 8% over 5 years:

- New Monthly Payment: ~1,800 SAR

- Monthly Savings: 900 SAR

- Simplified Tracking: One due date, one payment.

Proceed with Caution: Potential Pitfalls

- Long-Term Costs: Extending repayment might mean paying more interest over time.

- Hidden Fees: Some lenders charge origination fees or penalties for early repayment of old debts.

- Credit Score Risks: If your credit isn’t strong, you might not qualify for better rates.

Key Takeaways

- Compare Rates: Ensure the new loan’s interest rate is lower than your current average.

- Check Eligibility: Use free credit score tools to gauge your chances before applying.

- Change Habits: Consolidation isn’t a magic fix—avoid racking up new debt once you’ve streamlined the old.

Hey very nice site!! Man .. Beautiful .. Amazing .. I will bookmark your website and take the feeds also厈I am happy to find a lot of useful info here in the post, we need develop more strategies in this regard, thanks for sharing. . . . . .